Processing credit card payments cost money, which must be adequately passed along to the people incurring the charges - your clients. In Details, there are a couple of ways to cover the expense of payment processing, so let's go over our tools and when to use them!

If your client makes all their payments with a credit card, the Admin Fee is the right option. This fee is in your Worksheet Settings under the 'Options' menu. This fee will apply to all the charges within a specified event and will be itemized on your proposal. If you're using Details Invoicing with Stripe, this fee is a must to cover your cost!

Some of our clients apply this fee as a default and then provide a cash or check discount to offset the fee if the client does not use a credit card. Depending on your preferences and client base, this can be a great way to a) always cover your bases when it comes to payment processing costs and b) add some extra value and incentive for your clients to process payments with you in ways that do not incur any costs. Just a suggestion!

Check out this Support Center article, The Worksheet: Admin Fee.

The Convenience Fee in Details is meant for clients making payments with a combination of card and other methods. For example, maybe you have a client who makes the retainer payment by check and then processes later payments with a credit card. You need a way to cover your processing costs where they are incurred, and that's precisely what the convenience fee in Details is for!

Important note: verify your regional, state, and/or municipal laws regarding convenience fees before applying them. Details would recommend you consult a legal professional for advice.

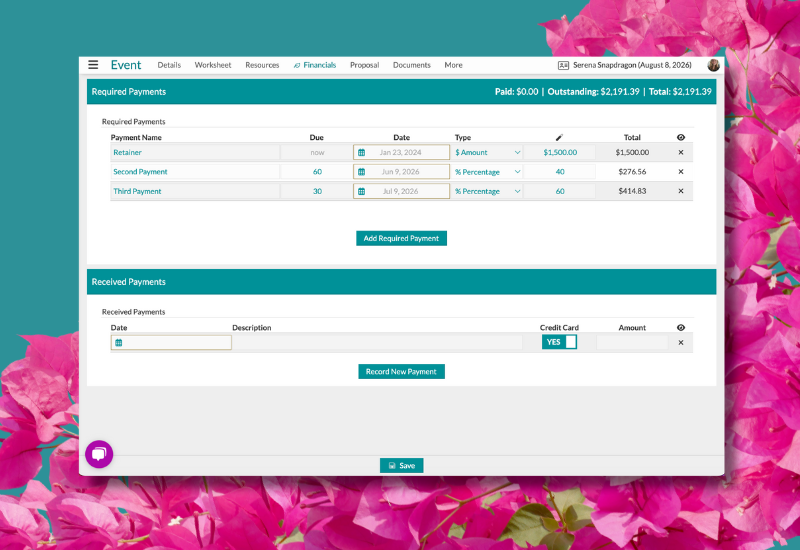

The fee amount is configured in your Financial settings, but it's applied on a payment-by-payment basis when you log in and mark them with the 'Credit Card' check-box. That way, you can charge a fee for a credit card payment without applying a blanket fee to charges that are being covered with some other method.

Check out this Support Center article, The Financials: Convenience Fee.

Now, the Convenience and Admin fees are just a few options. In some cases, depending on the laws of where you live, those fees will not work for your business. Rest assured, there are many ways to cover your costs, some more subtle than others!

For starters, you can add any fee you want to your worksheet. Navigate to the 'Fees' worksheet section (or add it) and then fill it out with what works for you; click here for instructions.

You can also factor additional fees into your markup, which will require some mathematical savvy! We have a Support Center article that breaks down additional fee percentages into your markup, and you can find it by clicking here.

Processing payments by card has become the most convenient way for your clients to get you paid for your services (especially with Details Invoicing through Stripe). Still, it's essential that you cover the expense of processing those payments so you're not taking the hit. We've outlined a few ways you can do that here because we know there's no one-size-fits-all solution. It's our mission to help each of our clients build their profitability. Understanding payment processing fees and when to use them is just one more step in that direction!

Follow Details on Instagram!